Merten Capital Strategy Insights Q2 Newsletter

MERTEN CAPITAL STRATEGY INSIGHTS

June 15, 2025

By: Mark R Merten, MBA

Global Political Shifts and Market Uncertainty

Over the past year, 70% of incumbents in elections worldwide have been voted out of office, suggesting a global mandate for change in governmental policies. Also, it is important to note that since the US election uncertainty was resolved in November the governments of South Korea, Germany, France, and most recently Canada have been thrown into turmoil.

The Latest Data

Despite political chaos and rumblings of dramatic change suggested by election results the political momentum of the past 10 years remains relatively unchanged.

Large Cap Tech Companies Driving Market Growth

Large Cap Technology Companies (high growth and cash-rich) based in the US continue to be the primary drivers of the stock market performance as global assets seek to outpace inflation. International markets and value stocks remain laggards in this environment. Market breadth is yet to expand in any meaningful way as of yet though several false starts have occurred over the past fiscal year.

The Latest Data

Inflation has stabilized for now at the higher end of US historical inflation range. As recent manufacturing output data reveals economic stagnation.

28% of stocks within the S&P500 index beat the performance of the index itself. Marking 2024 as the 2nd narrowest year in 30 years. This suggests the odds of market performance broadening out will continue to improve. However, it must be noted that 40% of small / midcap companies are currently unprofitable.

Prolonged Inflationary Pressures in the US Economy

The US remains in the early innings of a protracted inflationary period. Excessive government deficits/debt are the primary drivers of this trend - keeping downward pressure on fixed income investments. Interest rate and taxes should continue to rise. Holders of real assets (real estate, equities, etc) will keep pace with inflation while any protracted military engagements will exasperate these conditions.

The Latest Data

Unwinding of large-scale mass illegal immigration and unsustainable government hiring has appeared to aid in contributing to inflation moderation.

Decline of DEI Initiatives

The Latest Data

Public corporations and governmental departments continue to announce major initiatives to scale back DEI programs.

US Market Response: Tax Cuts, Deregulation, and Energy Expansion

US markets are pricing in new tax cuts and the extensions of expiring tax policies, broad deregulation, tougher trade policies, expanded US energy production (including nuclear), and scaling back 'green' policies and incentives.

Student Loan Debt

End of second quarter 2025 student debt made up 9% of the total household liabilities, the highest share on record. Over 40 million US households have outstanding student loan debt. Based on latest figures only 38% of borrowers are current in repayment and up to date.

Credit Card Debt

Q1 2025 credit card balances 90+ days delinquent climbed to 12.3% , the highest since 2011.

US EQUITY MARKETS SUPPLY / DEMAND FACTORS OF INTEREST

Capital Flight

Continued escalation of Ukraine military conflict and its implications for engulfing most of the European region remain positive for continued flight of capital into US market.

US economy remains #1 economy in the world by a large margin. GDP of the US is currently 27.72 trillion. vs. second largest China at 17.70 trillion. The fact that the US dollar remains the world's reserve currency and the vast majority of technology companies in the world are US-based makes the US most attractive for capital-seeking return in excess of inflation and safety.

- In 2024, China led as the top country with high net outflows of high net-worth individuals

Inflation

Residual Covid supply chain disruptions continued US government deficit (despite efforts such as DOGE to identify and address government waste) spending and growing probability of global military conflicts all support above-average inflation rates into the future.

Stock BuyBack Programs

2024 was another record year totaling over $940 billion in stock buybacks. 2025 is on track to exceed this record. Trend remains very supportive of continued higher stock market valuations going forward.

- Leading sectors repurchasing stock were

- Information Technology (26.2%)

- Financials (17%)

- Communciations (12%)

Tariffs

Tariffs historically lead to higher cost of goods as well as disruptions to established supply chains which both add positive inflationary pressure.

KEY INVESTMENT & ECONOMIC THEMES FOR 2025

1. Artificial Intelligence Integration into Everything

AI and human robots are slated to be a very disruptive technology on broad variety of fronts. Elon Musk is on record stating that he has no upper limit as to the general size of this emerging market.

Rideshare Going Robotic

2023 paid rideshare tickets exceeded 9.4 billion representing a current market of $250 billion. This was a 17% growth rate over 2022.

Waymo currently books 35,000 robotaxi rides per day. These rides, unlike Uber or Lyft, are completed in cars that are fully robotic and do not involve a human to operate the taxi.

2. Energy

On May 29th, President Trump signed 4 executive orders that directed the nation's independent Nuclear Regulatory Commission (NRC) to reduce regulations and expedite the licensing process for new reactors and power plants.

3. US Reindustrialization

4. Catering to the 'cash-strapped' consumer segment

5. Mass Appeal Consumer Marketplace

6. Defense / Space Contractors

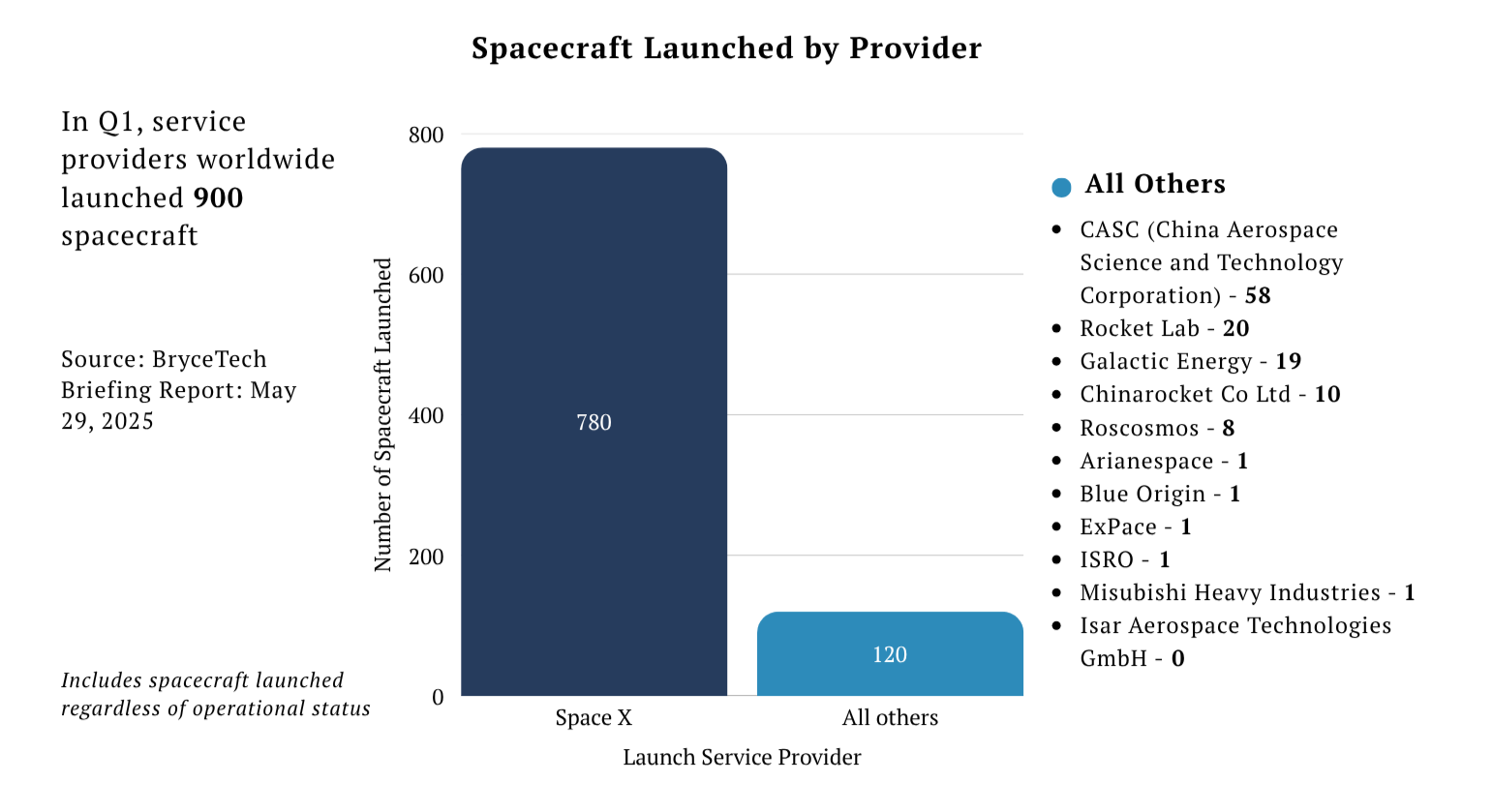

Space X currently leading all other launch service providers by large margin, having launched over 86% of the past years spacecrafts.

7. Alternative Fast Food Options

8. Home Builders

9. Banking Consolidation

10. Early Cancer Detection

11. Healthcare Sector Under Pressure

New governmental scrutiny on all aspects of healthcare sector has placed newfound uncertainty within the business models. As therefore negatively impacted stock prices. This uncertainty / scrutiny has no end in sight.

This research piece is provided for informational purposes only and does not constitute an offer to buy or sell any security or investment product. The information contained herein is based on sources believed to be reliable but is not guaranteed as to accuracy or completeness. Past performance is not indicative of future results. Investing involves risks, including the potential loss of principal.

Mark Merten is a registered investment adviser representative with Invest Capital Partners, Co., doing business as Merten Capital, a corporation registered with the Securities and Exchange Commission (SEC). Advisory services are offered solely through Invest Capital Partners, Co., dba Merten Capital. Neither Mark Merten nor Invest Capital Partners, Co., dba Merten Capital, provides tax or legal advice. You should consult with a qualified tax or legal professional before making any financial decisions.

Conflicts of Interest: Invest Capital Partners, Co., dba Merten Capital, and its representatives, including Mark Merten, may receive compensation, such as fees, for recommending certain investment products or services. Such compensation may create a conflict of interest. Clients are not obligated to act on any recommendations provided in this research piece. A detailed description of fees, services, and potential conflicts of interest is available in Invest Capital Partners, Co.’s Form ADV Part 2A (Brochure), which is provided to all clients and is available upon request or at www.mertencapital.com.

No Personalized Advice: This research piece is general in nature and does not take into account your individual financial situation, objectives, or risk tolerance. You should consultwith your financial advisor to determine whether any investment or strategy discussed is suitable for you.

Forward-Looking Statements: Certain statements in this research piece may be forward-looking and involve risks and uncertainties. Actual results may differ materially from those projected due to market conditions, economic factors, or other risks.

Third-Party Information: Some information in this research piece may be sourced from third parties. While we believe these sources to be reliable, Invest Capital Partners, Co., dba Merten Capital, and Mark Merten do not independently verify this information and are not responsible for any errors or omissions.

Contact Information: For more information about our advisory services or to request a copy of our Form ADV, please contact Invest Capital Partners, Co., dba Merten Capital, at 937-965-4045, mark.merten@mertencapital.com, or 5335 Far Hills Ave., Suite 306, Dayton, OH 45429. Additional information is available at www.mertencapital.com.

Regulatory Oversight: Invest Capital Partners, Co., dba Merten Capital, is subject to regulation by the Securities and Exchange Commission (SEC). You may verify the registration status of Invest Capital Partners, Co., dba Merten Capital, or Mark Merten through the SEC’s Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) (www.adviserinfo.sec.gov).